RL Blogs

By Ralph Laurel

Jul 09, 2012Location. Location. Location. Even in the refining business the location of a facility plays a huge role in how profitable it can be. |

||||||||

refinery, should not over-simplify logistics factors that have a compounding impact on refinery profitability. A good investment decision balances facility configuration with logistic competitiveness.

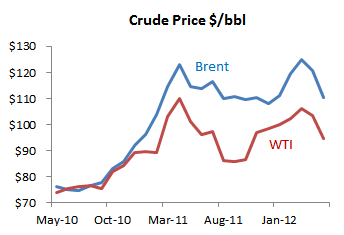

Crude Sourcing Arguably crudes sourcing plays the most vital role in refinery profitability. This has historically held true, and today has been rammed front and center. If you’ve followed any of the recent buzz over the past 18 months, you’ll know that U.S. refineries have had a

created by ample Canadian crude supply and re-energization of U.S. shale oil production has bought a little breathing room for U.S. refiners in what was a very dreary refining environment all but a year ago.

Anomalies aside, there are still some fundamental factors one should consider when assessing the crude sourcing situation for new a refinery build or acquisition. One leading thought should be means of delivery. Is it possible to receive crude by shipping vessels, or do you need a crude pipeline…or maybe even both? The available options drive the capital requirements on new facility infrastructure.

However, initial capital expenditure isn’t the only factor to consider. Continued supply chain costs will forever affect refinery margins. Vessel demurrage costs, pipeline tariffs, weather impacts, geopolitical influences, and crude supply availability are all factors that can quickly erode profitability.

Product Market Outlets In the macro-economic picture of global refining, refined product distribution continues to be a delicate international balance. Some regions possess the benefit of closed markets where outside suppliers cannot economically ship refined products into that market. Other markets have a cutthroat system where all players can compete.

Lowest cost provider ultimately prevails, and many factors influence a refiner’s production efficiency. Aside from refinery configuration capabilities, optionality in product supply channels plays a pivotal role. Beyond primary market outlets, investors need to understand alternative market disposition.

Refiners in mature markets have observed strong declines in local markets over the last decade. Competitive companies have successfully shifted product sales to other regions to maximize refinery utilization. Uncompetitive businesses end up running at reduced capacity or shutting down completely. Read up on how international competition has resulted in Australian refinery capacity reduction.

Logistic Flexibility Logistic Flexibility plays the pivotal enabler of crude sourcing and product outlet optimization. While different modes of transportation carry varying cost factors, the key is to maintain flexibility. I previously touched on crude transport means of vessels and pipelines, but alternative delivery options also include rail and truck. Yes…even trucks! Economies of scale may not exist for these other options, but it does not mean it’s not profitable.

Flexibility doesn’t have to indicate varying modes of transportation, but it can also apply to the capability of each mode. For example, most refiners receive crude shipment by ships. One nuance that many don’t appreciate is the limitation of water depth at the port of crude discharge.

It’s not uncommon for a refinery to short load a crude ship, or even utilize smaller ships if waterways do not allow bigger vessels to pass through. This dead-freight or inefficient shipping cost can reduce refinery profits by 10 cents per barrel, or $7 Million dollars a year for a 200 KBD refinery.

On the refined products side the story is the same. I discussed how access to alternative markets can bolster refinery profitability, but access is only one side of the equation. To capitalize on market outlets a refinery must possess logistic flexibility on the product side. A refinery that has crude flexibility doesn’t necessary have product flexibility since infrastructure requirements differ.

Since refined products meet various specifications for different product grades, the ability to transport products depends on how many infrastructure segregations a refinery possesses. Whether it’s through product pipeline, ships, or trucks, clean systems are required to maintain product integrity. Many refiners have limited infrastructure, and have limitations in reaching alternate markets.

Environmental, Safety, and Health Factors I’m convinced that with perfect hindsight companies would have chosen differently where to construct facilities. There’s always debate between less stringent regulations in developing countries vs those in developed countries. Beyond just finished product specification requirements, but also refinery operating regulations and compliance costs.

Want to put some hard numbers to this? Let’s assume that a recent evaluation on impacts of California’s AB32 (reduction of greenhouse emissions in state of California by 2020) are sounds. If so, it’s possible that California refiners will lose $3.7 Billion per year by 2020 for meeting regulations. That’s an average of $250 Million per refinery per year. According to the study, this could have an impact of 20% refining capacity reduction as refineries shut down.

Beyond the extremities of California politics, refinery location has a strong impact on operating costs as it relates to safety and health as well. It has become common practice for many oil companies to purchase green zones where population centers have encroached refinery property. To maintain a small buffer of land between operating units and communities, home purchase programs have been pursued.

Proximity to Industry Hubs As many supplemental processes and materials support complex refinery operations, proximity to industry hubs translates to economic advantages. No refinery has a perfect balance of commodity input and output. From raw materials, intermediate feedstocks, natural gas, hydrogen, nitrogen, electricity, LPG or even catalyst, all can have a complex supply chain.

Refineries that serve niche markets enjoy lower competitive forces, but at the cost of convenience. Any imbalance in commodity can require a large margin debit to offset. Take the Hovensa St. Croix or any island refinery for example. Ever care to wonder how they stay in fuel gas balance?

For some commodities refiners can manage the supply chain through logistic movements, but this can come at a cost. The constraints and costs are similar to the ones described above for Logistic Flexibility impacts.

Overall, margin impact can range from $5 Million per year to up to $20 Million per year depending on the commodity and the volume imbalance. Without diving into factors such as cooling water availability, climate impacts, and many more, you can imagine that a multitude of factors need to be carefully weighed when deciding where to build or buy a refinery. It’s fair to say that more thought is put into the initial costs than the continued maintenance and efficiency costs of a refinery.

We see that a spur of new refinery building activity has begun on one side of the world. On the other side, sales and acquisitions of existing refineries constantly make headlines. Parties involved in each of these events have a lot to consider, and time will tell which one has been successful in their evaluation.

|

|

|

|

|

.jpg)