RL Blogs

By Optimization Specialist Robert

Jun 24, 2019Considerations for managing the most difficult molecule in the refinery. |

||

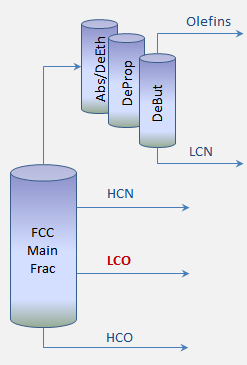

| If you work in a refinery, you’ll agree that finding the optimal routing for Light Cycle Oil (LCO) is one of the most difficult tasks.

Since LCO has such poor qualities as compared to other refinery stocks, managing LCO often becomes a decision of choosing the lesser evil. Either sell it as an unfinished stock at a discount, consume a lot of hydrogen to further process, or blend it into the diesel pool and sink your diesel specifications.

Many refinery LPs are not configured well to optimize LCO disposition since planning analysts often constrain LCO routings to minimize LP fluctuation. To help combat this practice, we will discuss the principles of LCO processing.

LCO Sales

The most straight forward outlet for LCO is to sell it directly into the market. This assumes that your refinery sits in a region where bunker blending is prevalent and there are off-takers for cutter stock. The sales price will depend on the quality of LCO as a cutter stock, specifically the sulfur content and viscosity.

Refineries with a FCC pre-treater can attain low sulfur LCO, and managing the distillation to reduce viscosity can add value to the LCO stream. However, downgrading LCO to HCO is rarely economic, so only consider viscosity optimization if your FCC main fractionator has a MCO/Intermediate Cycle Oil draw.

In most regions, LCO can be sold at 80 - 90% of finished diesel prices.

LCO Blending into Fuel Oil

If your refinery produces fuel oil product, you can capture value in LCO by using it as cutter. LCO does not cut as efficiently as jet/kero, but it sure does a better job than diesel.

The benefit of using LCO as fuel oil cutter is reducing the amount of LCO processed further in the refinery. All the nasty qualities of LCO become buried in fuel oil, so it’s almost a win-win for refineries that produce fuel oil.

LCO Direct Blending into Jet or Diesel Product

Depending on the availability of pre-treating FCC feed, LCO can sometimes be blended directly into Jet or Diesel product. For jet fuel, thermal stability and smoke point is often the primary consideration for LCO blending.

For diesel fuel, refiners need to consider aromatics and cetane specifications. LCO cetane is quite poor in the 10 -20 range and aromatics are very high in the 60 – 80% range. Finished diesel cetane specs ranging from 40 – 55 are challenged to blend much unprocessed LCO. Regions with aromatics specs < 30% also will be challenged to blend LCO.

LCO Treatment in a Diesel Hydrotreater

Some refineries have the ability to upgrade LCO into the diesel pool if hydrogen is available and specifications allow. As LCO is very aromatic, it can consume 2 – 3 times more hydrogen than straight run diesel, putting this at roughly 500 scf/bbl feed.

Hydrotreating LCO will saturate a portion of the aromatics, however, so there is a benefit of hydroprocessing for refiners limited by diesel aromatics specs. A refinery must first determine whether the value of hydrogen is worth the upgrade.

All things considered, upgrading LCO into finished diesel can be quite lucrative for refineries that can manage. The alternative of selling LCO as cutter can be a downgrade of $10 - $20 /bbl, so very much worth the effort.

LCO Upgrading in a Hydrocracker

The ultimate upgrade of LCO occurs in a hydrocracker. Depending on the relationship of gasoline vs diesel prices among other factors, LCO can be converted to good quality distillate fuel or even gasoline molecules in a hydrocracker.

The greatest consideration for hydrocracking LCO is the cost of hydrogen. Since LCO can consume between 2000 – 3000 scf/bbl of hydrogen, hydrocracking LCO is no minor feat.

Two-stage hydrocrackers have the additional complexity of determining the fractionator bottoms distillation to increase conversion of distillate material to gasoline. This comes at a cost of additional hydrogen consumption, but can be economic depending on the incremental cost of hydrogen and the price of gasoline.

Since hydrocrackers operate at very high pressures and utilize highly sophisticated catalyst, the gasoline and distillates produced have high qualities. Hydrocracker products are good reformer feedstocks, or have good blend properties for finished jet or diesel products.

Volume expansion is also another good driver for upgrading LCO in a hydrocracker, often yielding 15 – 20% increased volumetric yields. You are basically upgrading hydrogen to liquid product, even if it is LPG!

Upgrading LCO in a hydrocracker can add an additional $5 - 10 /bbl margin above hydrotreating alone, so essentially a $15 - 30 /bbl incentive vs direct sales.

Given the various outlets for managing LCO production, one can see how finding the right home can be challenging. The economics are dependent on nearly every price of oil commodities, as well as refinery configuration.

Since these factors change frequently, the moment you think you have a handle on optimal LCO disposition, it will shift again. I won’t even get into the questions related to optimizing the production of LCO, as that was previously discussed.

In the end, process engineers and optimization analysts need to carefully work together, and communicate frequently. There are big bucks tied to this operation that refineries can capture, or easily lose. | ||

|

|